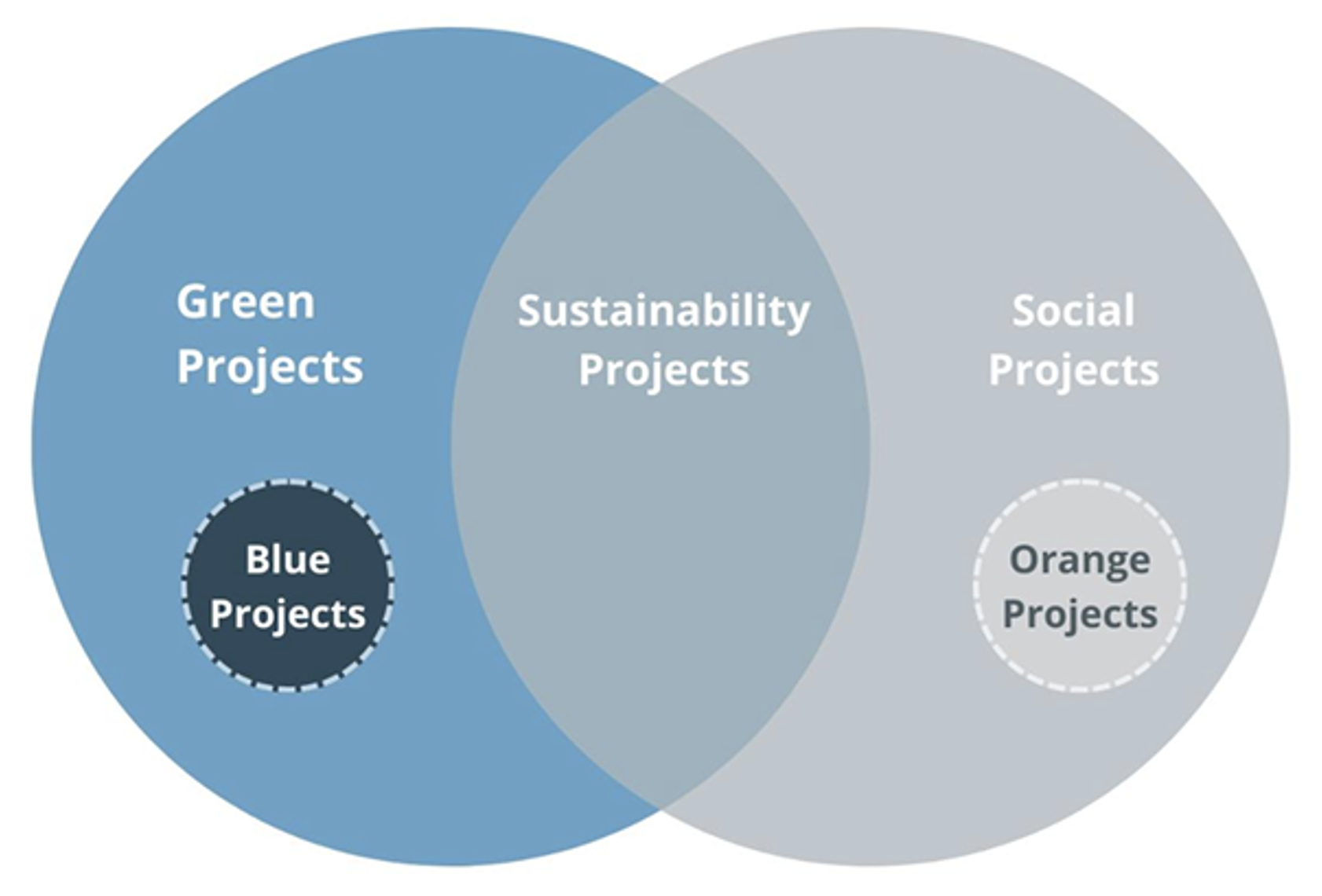

Sustainable Funding Framework outlines our approach for issuing Green, Social, Sustainability, Blue, Orange, and SDG-themed instruments—ranging from bonds, medium-term notes, sukuk, to loans and other facilities. These instruments mobilize capital for projects that generate measurable environmental and social impact in line with the United Nations Sustainable Development Goals (SDGs).

Proceeds from the Sustainable Funding instrument will be exclusively allocated to sustainable projects, including Renewable Energy, Energy Efficiency, Pollution Management and Prevention, Sustainable Natural Resources and Land Use Management, Clean Transportation, Sustainable Water and Wastewater Management, Green Buildings, Affordable Basic Infrastructure, Access to Essential Services, Affordable Housing, Food Security and Sustainable Food Systems.

All instruments issued under Sustainable Funding Framework comply with leading international and national standards, including:

The Second Party Opinion report by Sustainalytics, published on March 21, 2025, assessed that PT SMI’s Sustainable Funding Framework is credible, impactful, and aligned with the Sustainability Bond Guidelines 2021, Green Bond Principles 2021, Social Bond Principles 2023, as well as the Green Loan Principles and Social Loan Principles 2023.